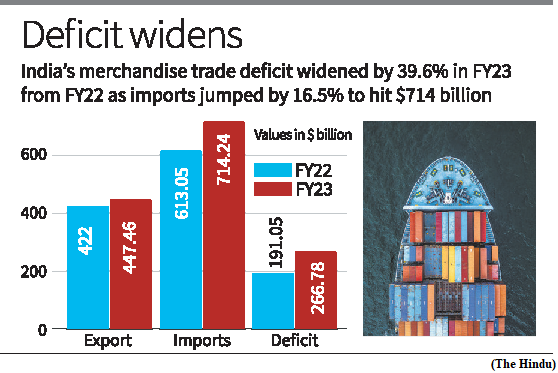

Goods exports grew 6 percent, imports 16.5percent in 2022-23 (GS Paper 3, Economy)

Why in news?

- India’s goods exports declined for the second successive month in March, falling a sharp 13.9% to $38.38 billion, while imports dipped 7.9% to $58.11 billion.

- Total goods exports in 2022-23 rose 6.03% to $447.46 billion, while the import bill surged by a steeper 16.5% to $714 billion in 2022-23.

Details:

- The goods trade deficit rose almost 40% to over $266 billion in 2022-23, compared to $190 billion in 2021-22.

- However, using estimates for services exports during March for which final data will only be available in May, the Commerce and Industry Ministry pegged the total trade deficit for the year at $122 billion, 46% higher than the $83.5 billion gap in 2021-22.

Top export items:

- India’s uptick in outbound shipments was largely led by petroleum, up 27% to $94.5 billion, followed by electronics goods that rose 7.9% to $23.6 billion.

- The other three of India’s top five export items registered insignificant growth: rice (up 1.5%), chemicals (1%), and drugs and pharmaceuticals (0.8%). Petroleum exports now account for 21.1% of total exports, up from 16% in 2021-22.

- Engineering goods, India’s mainstay in goods exports in recent years, shrank 5.1% to $107 billion, bringing down their share in total exports from 26.6% to 23.9%.

- Non-oil exports, in fact, contracted 0.5%, and if electronics exports were excluded too, goods shipments were 2.8% lower than 2021-22, which economists called a red flag.

Russian imports surge:

- Fuelled by discounted oil shipments, India’s imports from Russia grew almost 370% to over $46 billion in 2022-23.

- Russia’s share in imports leaped from 1.6% in 2021-22 to 6.5% last year, making it the fourth largest import source nation for India, behind China, the UAE and the U.S.

China’s share in imports:

- China’s share of goods imports dipped to 13.8% in the year gone by from 15.4% in 2021-22. However, imports from the country still grew 4.2% to reach $98.5 billion last year, while exports to China fell 28% to just $15.3 billion.

- Indian shipments to China now account for just 3.4% of total exports, from over 5% in 2021-22.

Indian imports:

- While petroleum imports jumped about 30% to nearly $210 billion in 2022-23, coal imports grew at a faster 57% to almost touch $50 billion.

- Gold imports, on the other hand, fell around 24% to $35 billion as global prices for the metal surged and the rupee turned weaker.

- The U.S. remained India’s top export destination, followed by the UAE, while the Netherlands emerged as the third largest goods buyer, displacing China to the fourth position in 2022-23.

Way Forward:

- With the government setting a $2 trillion target for goods and services exports by 2030 under the new Foreign Trade policy, the apex exporters’ body FIEO sought marketing support to sell their wares around the world and an exemption from the Goods and Services Tax levied on freight for goods shipments.

What is ‘Dabba trading’ and how does it affect the economy?

(GS Paper 3, Economy)

Why in news?

- Recently, the National Stock Exchange (NSE) issued a string of notices naming entities involved in ‘dabba trading’.

- The bourse cautioned retail investors to not subscribe (or invest) using any of these products offering indicative/assured/guaranteed returns in the stock market as they are prohibited by law.

- It added that the entities are not recognised as authorised members by the exchange.

What is ‘dabba trading’?

- Dabba (box) trading refers to informal trading that takes place outside the purview of the stock exchanges. Traders bet on stock price movements without incurring a real transaction to take physical ownership of a particular stock as is done in an exchange.

- For example, an investor places a bet on a stock at a price point, say ₹1,000. If the price point rose to ₹1,500, he/she would make a gain of ₹500. However, if the price point falls to ₹900, the investor would have to pay the difference to the dabba broker. Thus, it could be concluded that the broker’s profit equates the investor’s loss and vice-versa. The equations are particularly consequential during bull runs or bear market.

- The primary purpose of such trades is to stay outside the purview of the regulatory mechanism, and thus, transactions are facilitated using cash and the mechanism is operated using unrecognised software terminals.

- Other than this, it could also be facilitated using informal or kaccha (rough) records, sauda (transaction) books, challans, DD receipts, cash receipts alongside bills/contract notes as proof of trading.

Where does it become particularly problematic?

- Since there are no proper records of income or gain, it helps dabba traders escape taxation. They would not have to pay the Commodity Transaction Tax (CTT) or the Securities Transaction Tax (STT) on their transactions.

- The use of cash also means that they are outside the purview of the formal banking system. All of it combined results in a loss to the government exchequer.

- In ‘dabba trading’, the primary risk entails the possibility that the broker defaults in paying the investor or the entity becomes insolvent or bankrupt. Being outside the regulatory purview implies that investors are without formal provisions for investor protection, dispute resolution mechanisms and grievance redressal mechanisms that are available within an exchange.

- Since all activities are facilitated using cash, and without any auditable records, it could potentially encourage the growth of ‘black money’ alongside perpetuating a parallel economy. This could potentially translate to risks entailing money laundering and criminal activities.

What does the scenario look like?

- Other than taxation, what lures potential investors is their aggressive marketing, ease of trading (using apps with quality interface) and lack of identity verifications.

- Depending on the individual’s trading profile, observable volumes and trends, brokers keep their fees and margins open to negotiation as well.

- The mechanism could potentially translate into ripple effects for the regulated bourse as well by inducing volatility when dabba brokers look to hedge their exposures (take position in an alternate asset or investment to reduce the risk/loss with the current position). It also contributes to the bourse losing out on volumes, “even though they may not be significant”.

- ‘Dabba trading’ is recognised as an offence under Section 23(1) of the Securities Contracts (Regulation) Act (SCRA), 1956 and upon conviction, can invite imprisonment for a term extending up to 10 years or a fine up to ₹25 crore, or both.

Amit Shah launches Vibrant Villages Programme in Arunachal

(GS Paper 2, Governance)

Why in news?

- Recently, Union Home Minister Amit Shah was in Arunachal Pradesh for the launch of the ‘Vibrant Villages Programme’ (VVP) in the border village of Kibithoo.

- The constant threat along the country’s border amid the ongoing standoff with China has led to a concerted push to upgrade infrastructure in the border areas.

- To this end, the Union Cabinet on February 15 approved the allocation of Rs 4,800 crore for the Centre’s ‘Vibrant Villages Programme.’

What is the ‘Vibrant Villages Programme’?

- This village development scheme was first announced in the 2022 Budget.

- The programme’s targets are to provide comprehensive development of villages on the border with China and improvement in the quality of life of people living in identified border villages. The development in these villages will help prevent migration, and thus also boost security.

- The Parliamentary Standing Committee in 2018 had pointed towards backwardness, illiteracy, and lack of basic facilities and infrastructure in our border areas. The VVP aims to address all these issues.

Which states come under VVP?

- Under this centrally sponsored scheme, 2,967 villages in 46 blocks of 19 districts have been identified for comprehensive development.

- These villages abut the border in the states of Arunachal Pradesh, Sikkim, Uttarakhand and Himachal Pradesh and the Union Territory of Ladakh. In the first phase, around 662 villages have been identified for priority coverage.

What are the funds allocated for the programme?

- According to Shah, a population of about 1.42 lakh people will be covered in the first phase. Under the programme, the government has allocated Rs 4,800 crore for infrastructure development and to provide livelihood opportunities in the border areas.

- Out of the total outlay, Rs 2,500 crore will be spent exclusively on the creation of road infrastructure. The total outlay is for financial years 2022-23 to 2025-26. There is a conscious effort to not overlap VVP with the Border Area Development Programme.

What are the objectives of the scheme?

- The aims of the scheme are to identify and develop the economic drivers based on local, natural, human and other resources of the border villages, as per a press release by the Ministry of Home Affairs on February 15, 2023.

- Development of growth centres on the “Hub and Spoke Model” through promotion of social entrepreneurship, empowerment of youth and women through skill development is also one of the objectives of VVP.

- Moreover, the programme also intends to leverage tourism potential through promotion of local, cultural, traditional knowledge and heritage in the border areas, thus increasing the employment opportunities of the people and, as a result, stemming migration.

- Development of sustainable eco-agribusinesses on the concept of “One village-One product” through community-based organisations, cooperatives, SHGs, NGOs etc is also aimed at.

- The district administration will prepare action plans with the help of Gram Panchayats for the identified villages to ensure 100 per cent saturation of Central and state schemes.

- The scheme envisages that drinking water, 24×7 electricity, connectivity with all weather roads, cooking gas, mobile and internet connectivity be made available in the border areas.

- Special attention will be given to solar and wind energy, tourist centres, multi-purpose centres and health infrastructure and wellness centres.