Seven products from U.P. get GI tag (GS Paper 3, Economy)

Why in news?

- The Geographical Indications Registry in Chennai has given tags to seven different products from Uttar Pradesh.

- ‘Amroha Dholak’, ‘Mahoba Gaura Patthar Hastashlip’, ‘Mainpuri Tarkashi’, ‘Sambhal Horn Craft’, ‘Baghpat Home Furnishings’, ‘Barabanki Handloom Product’ and ‘Kalpi Handmade Paper’ are the products that been given the Geographical Indication (GI) tag.

Key Highlights:

Amroha Dholak:

- The Amroha Dholak is a musical instrument made of natural wood.

- Mango, jackfruit and teakwood is preferred for making the dholak.

- Wood from mango and sheesham trees are used to carve the multiple sized and shaped hollow blocks, which are later fitted with animal skin, mostly goatskin, to create the instrument.

Baghpat Home Furnishings:

- Baghpat and Meerut are famous for their exclusive handloom home furnishing product and running fabrics in cotton yarn since generations, and only cotton yarn are used in the handloom weaving process.

Kalpi Handmade Paper:

- Historical details for Kalpi Handmade Paper show that Munnalal ‘Khaddari’, a Gandhian, formally introduced the craft here in the 1940s, though many locals say that Kalpi’s association with paper-making dates further back into history.

- The handmade paper-making cluster at Kalpi is a huge cluster, engaging more than 5,000 craftsmen and approximately 200 units.

Mahoba Gaura Patthar Hastashlip:

- The Mahoba Gaura Patthar Hastashlip is a stone craft.

- It is a very unique and soft stone with scientific name, the ‘Pyro Flight Stone’.

- Gaura stone craft is made of radiant white-coloured stone that is predominantly found in this region. It is used for making craft items.

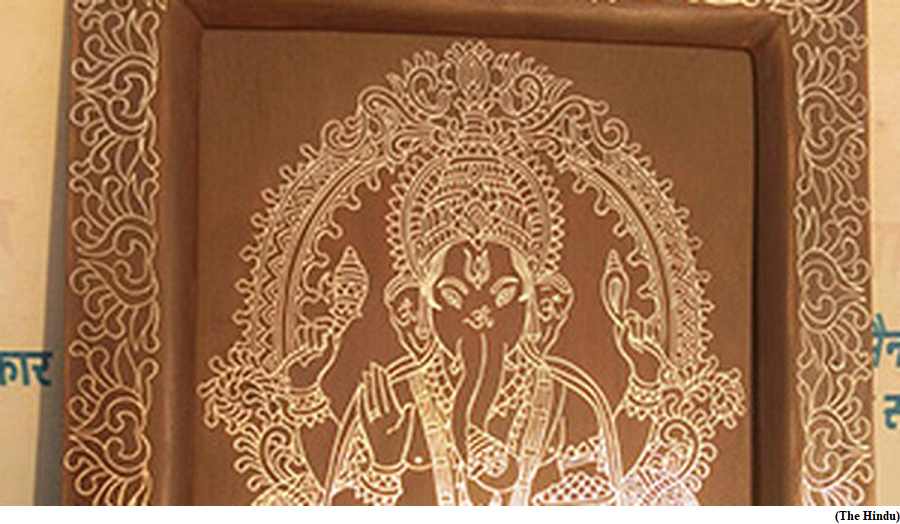

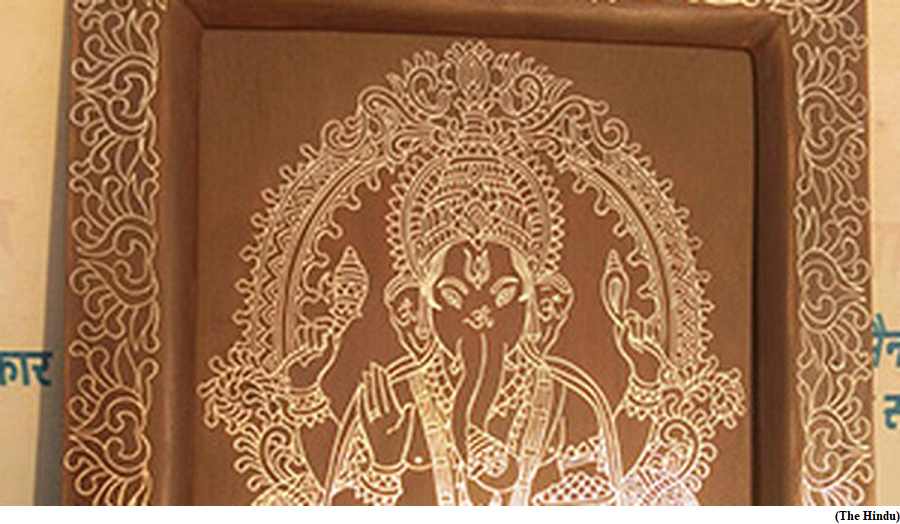

Mainpuri Tarkashi:

- Tarkashi, a popular art form from Mainpuri, is primarily brass wire inlay work on wood.

- It was mainly used for khadaous (wooden sandals), a necessity for every household, since leather was considered unclean.

Sambhal Horn Craft:

- For the Sambhal Horn Craft, the raw material is procured from dead animals. They are hand-made.

India ranked 67th globally on Energy Transition Index, Sweden on top, WEF

(GS Paper 3, Economy)

Why in news?

- Recently, the World Economic Forum in collaboration with Accenture, published its Energy Transition Index report.

- It ranked India at the 67th place globally on its Energy Transition Index and said it is the only major economy with energy transition momentum accelerating across all dimensions.

Key Highlights:

- Sweden topped the list and was followed by Denmark, Norway, Finland and Switzerland in the top five on the list of 120 countries.

- France (7) was the only G20 country in the top 10, followed closely by Germany (11), the US (12), and the UK (13).

- Out of 120 countries, 113 have made progress over the last decade but only 55, including India, have improved their scores by more than 10 percentage points.

Observations about India:

- Achieving universal access to electricity, replacing solid fuels with clean cooking options and increasing renewable energy deployment have been primary contributors to the improvement of India's performance.

- India also emerged relatively less affected from the recent energy crisis, largely due to the low share of natural gas in power generation and increased use of existing generation capacities.

- The energy mix, however, remains predominantly carbon intensive, with a low share of clean energy in final demand.

- The pace of thermal power plant expansion has considerably slowed in India, though strategies for early retirement or repurposing of the existing fleet will be crucial.

Way Forward for India:

- Continued progress will be challenged by two key macro trends: strong economic growth, and the urgency to create quality jobs for a growing working age population.

- A skilled workforce, public-private collaboration in innovation, and investment in research and development in low-carbon technologies are necessary to enable India's energy transition.

The concerns about India-U.S. digital trade

(GS Paper 3, Economy)

Why in news?

- During Indian Prime Minister’s U.S. state visit, cooperation on technology emerged as a prominent talking point and yielded some of the most substantive outcomes.

- However, digital trade is also the area where some of the biggest U.S. tech companies have recently flagged multiple policy hurdles, including “India’s patently protectionist posture”.

Background:

- Earlier the Washington D.C.-headquartered Computer & Communications Industry Association (CCIA), with members like Amazon, Google, Meta, Intel, and Yahoo, flagged 20 policy barriers to trading with India in a note titled “Key threats to digital trade 2023”.

What is the current status of India-U.S. technology trade?

- In FY2023, the U.S. emerged as India’s biggest overall trading partner with a 7.65% increase in bilateral trade to $128.55 billion in 2022-23. However, digital or technology services did not emerge as one of the sectors at the forefront of bilateral trade.

- Despite the strength of the U.S. digital services export sector and enormous growth potential of the online services market in India, the U.S. ran a $27 billion deficit in trade in digital services with India in 2020.

- Both countries have been ramping up their tech partnership through moves like the Initiative on Critical and Emerging Technology (iCET) announced by US President and Indian PM in 2022.

- Additionally, under the iCET, India and the U.S. also established a Strategic Trade Dialogue with a focus on addressing regulatory barriers and aligning export controls for smoother trade and “deeper cooperation” in critical areas.

What have U.S. tech firms flagged?

- The CCIA noticed the “significant imbalance” and “misalignment” in the U.S.-India economic relationship. It said that the Indian government has deployed a range of “tools to champion their protectionist industrial policy”, tilting the playing field away from U.S. digital service providers in favour of domestic players.

- To describe these “discriminatory regulation and policies”, it cites the example of India’s guidelines on the sharing of geospatial data, which it accuses of providing preferential treatment to Indian companies.

- It has also expressed discontent over India’s turning away from “longstanding democratic norms and values, and seeking greater government censorship and control over political speech”, which it argues has made it “extremely challenging for U.S. companies to operate in India”.

What taxation measures has the CCIA raised concerns about?

- One of the taxation tools that U.S. tech firms have long taken exception to is the expanded version of the “equalisation levy” that India charges on digital services.

- India in 2016, with the goal of “equalising the playing field” between resident service suppliers and non-resident suppliers of digital services imposed a unilateral measure to levy a 6% tax on specific services received or receivable by a non-resident not having a permanent establishment in India, from a resident in India who carries out business.

- In 2020, the Centre came out with the ‘Equalisation Levy 2.0’, which imposes a 2% tax on gross revenues received by a non-resident “e-commerce operator” from the provision of ‘e-commerce supply or service’ to Indian residents or non-resident companies having a permanent establishment in India.

- The equalisation levy, when it was first introduced in 2016, led to double taxation and further complicated the taxation framework. Besides, it also raised questions of constitutional validity and compliance with international obligations.

- The 2020 amendment again led the levy to become sweeping and vague in its scope.

- Further, in 2021, instead of introducing an amendment, the government issued a “clarification” to say that the expression ‘e-commerce supply or service’, inter alia, includes the online sale of goods or the online provision of services or facilitation of the online sale of goods or provision of services.

What about India’s IT Rules 2021?

- The Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, has been flagged by the consortium of foreign tech firms under the some of the most “problematic policies”.

- The IT Rules place compliance burden on social media intermediaries (SMIs) and platforms with five million registered users or more, which means several U.S. firms end up falling under the ambit.

- Some points of concern raised are the “impractical compliance deadlines and content take-down” protocols, the IT Rules require intermediaries to take down content within 24 hours upon receiving a government or court order. The platforms are also required to appoint a local compliance officer.

- Moreover, with the amendments made to the Rules late in 2022, SMIs are now obligated to remove, within 72 hours, information or a communication link in relation to the six stipulated prohibited categories of content as and when a complaint arises.

- There is also major criticism against the government’s institution of the three-member Grievance Appellate Committees (GAC), which will hear user complaints about the decisions of SMIs regarding their content-related issues and have the power to reverse those decisions.

What has been flagged in the new draft of the data protection law?

- While the firms appreciate a “notable improvement” in the government’s new draft (and the fourth iteration) of the Digital Personal Data Protection Bill released in November 2022, ambiguities about cross-border data flows, compliance timelines, and data localisation still remain.

- India’s policy on the flow of data across borders will impact the same on a global level, as was seen with the European Union’s landmark General Data Protection Regulation (GDPR).

- Foreign tech companies like Meta or Amazon operating in India find it convenient to store their data, say in the U.S. or wherever they have their servers. This means that such data has to leave Indian borders.

- The new draft has only one line about cross-border data flows — Section 17 of the Act says that cross-border flow of data will only be allowed for a list of countries notified by the Centre. On what basis will these countries be notified and what will the terms for such transfers be is not mentioned in the draft.

- The CCIA argues that instead of taking this “opaque” approach, the law could be strengthened by “proactively supporting cross-border data flows through certifications, standard contractual clauses and binding corporate rules”.

What have firms said about the Telecom bill?

- The CCIA contends that the draft Telecommunications Bill, 2022, has a sweeping regulatory ambit in that it “would redefine “telecommunication services” to include a wide range of internet-enabled services that bear little resemblance to the telephony and broadband services previously governed by this regulatory regime”.

- The current draft of the Bill puts both Telecom Service Providers (TSPs) and Over-the-top (OTT) communication services under the definition of “telecommunication services”.

- The CCIA contends in its note that the proposed law if passed in its current form, would subject a number of platforms to “onerous obligations including licensing requirements; government access to data; encryption requirements, internet shutdowns, seizure of infrastructure, and possibly monetary obligations for the sector”.