‘Freebies’, a judicial lead and a multi-layered issue (GS Paper 2, Governance)

Context:

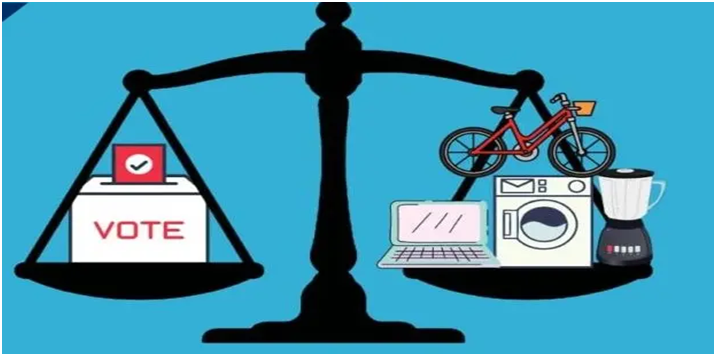

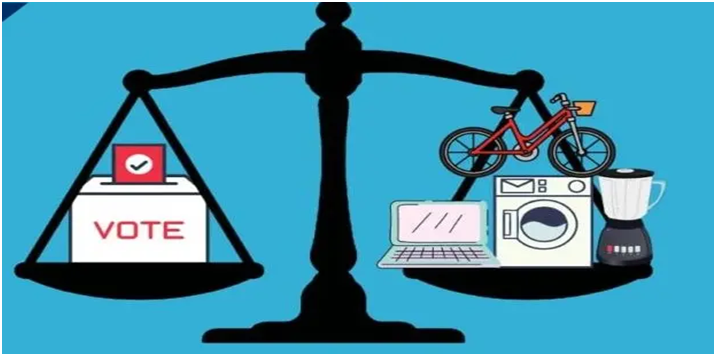

- The Prime Minister’s recent comment on “freebies” handed out by governments has reignited the debate on the economic rationale for granting subsidies.

Subsidies vs. freebies:

- Market fundamentalists have seized the opportunity to point yet again that subsidies are, per se, undesirable for they contribute to suboptimal outcomes for the economy.

- This unbridled affront on subsidies does not make a distinction between transfer payments that are made for running social welfare schemes.

- When this debate began to go astray, it needed a strong reminder by the Supreme Court of India that in the on-going debate on subsidies and “freebies”, a distinction had to be made between expenditure made on social welfare schemes and “irrational freebies” offered to voters during elections.

Need for subsidies:

- The lead given by the Supreme Court to engage in a discussion on subsidies must be seen as the starting point to deal with an issue that is truly multi-layered.

- This becomes evident from a close reading of the Union Budget and the manner in which the various governments have presented data pertaining to subsidies and transfer payments.

- A more critical aspect is to understand why it is imperative for the Government to continue with agricultural subsidies and extend support to ensure that health and educational services are available to all.

What can be considered “subsidies”?

- Although ‘subsidy’ is among the most discussed issues, a legally acceptable definition of this instrument is hard to come by. One exception is the Agreement on Subsidies and Countervailing Measures (ASCM) of the World Trade Organization.

- According to ASCM, a subsidy shall be deemed to exist if there is a financial contribution by a government or any public body where government practice involves a direct transfer of funds (e.g., grants, loans and equity infusion), and/or government revenue that is otherwise due is foregone or not collected, and/or a government provides goods or services.

- ‘Subsidy’ can also be any form of income or price support granted by the government. This is a comprehensive definition of what subsidies are, for it includes not only direct transfer payments by the governments but also taxes and charges that are not collected. This aspect has gone under the radar in the on-going discussion.

ASCM in Union Budget:

- The Union Budget has provided data on direct subsidies and transfer payments from 2006-07 in a statement titled “Revenue Foregone under the Central Tax System” annexed to the Receipts Budget.

- Thus, the Union Budget includes all categories of subsidies that figure under the ASCM definition. However, from the Union Budget 2015-16 onwards, the title of the annexure was changed to “Statement of Revenue Impact of Tax Incentives under the Central Tax System”.

- So, replacing the term “revenue foregone” with “tax incentives” in the title of the Annexure was just a change in semantics.

Policy and measures:

Tax preferences:

- Tax policy includes a range of measures that include special tax rates, exemptions, deductions, rebates, deferrals, and credits, all of which affect the level and distribution of tax.

- These measures are often called“tax preferences”, which are built into both direct and indirect tax regimes for realising specific benefits serving the greater public good.

- For instance, the Income-tax Act includes “tax preferences” to promote savings by individuals and for enhancing exports, creation of infrastructure facilities and scientific research and development by corporates.

- On the other hand, customs duty concessions are intended to promote exports. The more substantive point here is that tax preferences are considered as implicit (indirect) subsidies to preferred tax payers; therefore, they merit attention in the current debate on justification of subsidies.

Revenue foregone in the case of direct taxes:

- Data on revenue foregone was first provided along with the Receipts Budget of 2006-07 covering both direct and indirect taxes.

- The significance of revenue foregone in the case of direct taxes was underlined in a 2016 Comptroller and Auditor General of India (CAG) report in 2016, which showed that revenue foregone in 2010-11 was 21% of direct tax revenue and had decreased to 15% in 2014-15.

- However, a subsequent report showed that the share had climbed again to reach 22% of tax revenue in 2019-20.

Facets of the “tax preferences:

- There are several important facets of the “tax preferences” provided by the Government in respect of direct taxes that are germane to this debate on subsidies.

- First, as compared to individuals, corporates have been enjoying a larger share for all years except in 2019-20 when the share of individuals inexplicably increased. The figures of 2019-20 are significant also because “tax preferences” for corporates registered an increase, even as corporate taxes were reduced.

- And, finally, while the Finance Minister spoke about eliminating “tax preferences” available to income-tax payers in lieu of lower tax slabs, which is optional at present, the corporate sector enjoys “tax preferences” as well as lower tax rates.

Fading support:

- This brings to a much larger issue of targeting agricultural subsidiesand also support provided to public health and education for making these services available to all.

- Market fundamentalists have forever opposed these subsidies/support by arguing that they are a wasteful use of resources. But this argument has gained currency since every Central government in the past three decades has adopted policies to whittle down support to these sectors extended by the government.

- Public health and education have consistently been undermined to create space for private players. And, in agriculture, the Government had brought the controversial farm laws for dealing with the issue of increasing farm subsidies.

An underinvestment:

- While adopting policies targeting these sectors, successive governments have paid little attention to the dismal reality of under-investment in these sectors.

- Public expenditure on health has struggled to cross 1.5% of GDP, which is significantly lower than those in other major economies. In education, the Kothari Commission’s target set in 1966, that public investment should be increased to “6 percent of the national income as early as possible” is but a distant dream.

- That agriculture has remained the neglected sector hardly needs to be emphasised. The most galling fact is the astonishingly low share of the country’s investment that this sector receives. At the turn of the millennium its share was 10%; in recent years, it has almost halved.

- As the crisis in agriculture has deepened as a result of this chronic underinvestment, subsidies have been the palliatives extended by the Government for farmers to merely protect their livelihoods.

PM Modi’s security breach in Punjab: SC panel report

(GS Paper 3, Internal Security)

Why in news?

- Recently, the Supreme Court-appointed Retired Justice Indu Malhotra committee, for looking into Prime Minister Narendra Modi’s security breach in Punjab in 2022 has submitted its report.

Background:

- In January, the entire nation got a jolt when visuals of Prime Minister’s cavalcade being stuck on a flyover in Punjab splashed across TV channels and social media.

- The PM’s convoy was surrounded with hundreds of protesters in multiple vehicles for a full 20 minutes even as personnel of Punjab Police were seen chilling with them over a cup of tea.

- It didn’t make for a pretty sight as the most important leader of the country was vulnerable and his security under serious breach in one of the most critical states of the country that also shares a border with Pakistan.

Breach of conventions:

- PM Modi was on a visit to Punjab which from the very beginning looked compromised in terms of security.

- As per the convention, neither the DGP nor the Chief Minister of the state were present to receive him. At that time, the Congress was still in power and Charanjit Singh Channi was the Chief Minister of the state.

- The PM was originally scheduled to fly to the National Martyrs Memorial at Hussainiwala; however, bad weather led to a change in plan of which Punjab Police was informed well in advance.

Findings of independent panel appointed by the Supreme Court:

- According to the Supreme Court-appointed Retired Justice Indu Malhotra committee, it was the Ferozpur SSP who failed in executing his duty of ensuring the Prime Minister’s security despite having the necessary information around two hours in advance.

- The Supreme Court bench headed by Chief Justice NV Ramanaheld Harmandeep Singh Hans, Ferozepur SSP, responsible for not acting to ensure PM Modi’s safety despite having sufficient force at his disposal and despite key inputs that hostile groups were present on the route that the prime minister was taking.

- The bench is now going to send the report to the Centre so that appropriate action can be taken.

Who is Harmandeep Singh Hans?

- Harmandeep Singh Hans is a 2015 batch IPS officer of Punjab cadre and will retire from the services in 2050. He secured All India rank 101 in the UPSC exam and is also credited with eliminating drug mafia during his stint as the SP of Mohali.

- Hans was immediately transferred by the Channi government as a damage-control move and posted as the commandant of the third battalion in Ludhiana.

- The Bharat Kisan Union (Krantikari) president Surjeet Singh Phool who was leading the protest had claimed in an interview that he was informed by the Punjab Police of this VVIP movement in advance. However, then CM Channi had claimed that it was a “kudrati” (natural) event.

Critical security in border states:

- Security around the border states is becoming critical day by day due to the changing nature of warfare. The incidents of Indian forces intercepting drones sent from across the border into Indian territory have dramatically increased.

- The volume of these drones and their ability to inflict serious damage are also increasing. What’s most worrying is the precision with which these drones can be used to target VIP locations and movements.

VVIP movements globally:

- VVIP movements are taken with utmost seriousness across the world. India has already lost two of its Prime Ministers; Indira Gandhi and Rajiv Gandhi to lethal attacks.

- In July 2022, the world again lost a very important leader, former Japanese PM Shinzo Abe, in Japan’s city of Nara where he was assassinated while speaking during a political event in the run-up to the elections.

Way Forward:

- In India, VVIP security is guided by a “Blue Book” that has elaborate instructions on ensuring security. What happened in Punjab wasn’t just unfortunate but it also raises questions on the Congress government which was in power.

- Political games aside, security of the Prime Minister is non-negotiable. It remains to be seen the action that the Centre will take against those responsible. There is need to set a tough example.

Amendment in the Indian Telegraph Right of Way (RoW) Rules, 2016

(GS Paper 2, Governance)

Why in news?

- Recently, Ministry of Communications released amendment in the Indian Telegraph Right of Way (RoW) Rules, 2016 to facilitate faster and easier deployment of Telecom Infrastructure and launched a new 5G RoW application 'form’ on GatiShakti Sanchar Portal to enable faster 5G roll-out in India.

4 ways for ensuring faster rollout of 5G services:

The 4 basic ingredients for ensuring faster rollout of 5G services across the countryare

- allocation of spectrum,

- reforms in the processing of RoW permission,

- co-operative federalism and

- rollout of services.

GatiSakti Sanchar Portal:

- GatiSakti Sanchar Portal was launched by DoT in May, 2022 in line with PM’s vision of development of infrastructure services in an integrated manner.

- The IT systems of all States/UTs and major infrastructure central ministries such as Railway, Highways have been integrated with the portal to make India ready for 5G launch.

13 States/UTs have also implemented deemed approval clause in their RoW Policies ensuring speedy approvals. These measures have resulted in major reduction in average time for approval of RoW applications, from 435 days in 2019 to 16 days in July, 2022.

Rules, 2016.png)

The salient features of the amendments are as follows:

Expansion of telecom infrastructure:

- To facilitate faster 5G roll-out, RoW application procedures for small cell has now been simplified. Telecom licensees will be able to use street infrastructure to deploy telecom equipment at a nominal cost of Rs. 150/annum in rural areas and Rs. 300/annum in urban areas.

- To facilitate faster fiberisation, street infrastructure may be utilized at a nominal cost of Rs. 100/annum to install overground optical fibre.

- The amendments create distinction between ‘poles’ and ‘mobile towers’. Overground infrastructure of height up to 8 meters shall be treated as poles and will need minimal regulatory permissions for deployment.

Improving ease of doing business:

- Telecom licensees had to submit RoW applications on different platforms of State/UTs. The amendments provide for a single window clearance system for RoW applications.

- Gati Shakti Sanchar Portal of Ministry of Communications will be the single window portal for all telecom related RoW applications.

- Single window clearance will reduce multiplicity of compliance and facilitate easier approvals.

Rationalization of fees/charges:

Rationalization of administrative fees:

- Telecom licensees are required to pay administrative fees for the RoW permissions. As technology improves, significant telecom equipment will be deployed on poles. To reduce the cost of compliance, the administrative fees have been rationalized as follows:

- No administrative fee shall be charged by Central Government or its agencies for establishment of poles on the land owned/controlled by them.

- For State/UTs, the administrative fee for establishment of poles shall be limited to Rs. 1,000 per pole.

- Administrative Fee for laying overground optical fiber shall be limited to Rs. 1,000/ Km.

Uniformity in calculation of area:

- Telecom licensees have to pay charges proportionate to the area occupied by telecom infrastructure. At present, different agencies use different methodology to calculate the area.

- The amendments now prescribe a methodology to calculate the area occupied by telecom infrastructure. This will bring uniformity in computation of area and associated charges for the telecom infrastructure across the country.

Rationalizing cost of restoration:

- In case of restoration, Telecom licensees either have to undertake the restoration themselves or pay the concerned authority for restoration work. To ease this process, two major reforms have been introduced.

- If the Telecom licensee undertakes the restoration work, a Bank Guarantee amounting to 100% of restoration cost needs to be submitted to the concerned agency. This amount has now been rationalized. Telecom Licensee shall be required to submit a BG for an amount of 20% of the restoration cost only.

- If the Telecom Licensee wishes to pay the concerned agencies, the cost of restoration shall be calculated at the rates prescribed by Central Public Works Department (CPWD) or Public Works Department (PWD) of the State/UTs.

- No compensation for establishment of poles: Telecom licensees shall not be required to pay compensation for land for establishment of poles.

Incentivizing use of technology:

- Technology is now available for laying Optical Fiber without digging a full trench. Therefore, in case of fiber laid using horizontal directional digging technology, Telecom Licensee shall have to pay restoration charges only for the pits, and not for the entire route.

- These reform measures are aimed at bringing down the time and cost of deployment of telecom infrastructure.

Telecom infrastructure over private property:

- For installing telecom infrastructure on private property, Telecom licensees may enter into agreement with private property owners and they will not require any permission from any government authority.

- In such cases, Telecom licensees shall be required to give only prior intimation along with structural suitability certificate.

Way Forward:

- These measures are expected to facilitate rapid expansion and upgradation of telecom networks and therefore improvement in the quality of services.

- With these series of reforms, the country is now ready for launch of 5G services by October, 2022.

Government notifies Battery Waste Management Rules, 2022

(GS Paper 3, Environment)

Why in news?

- Recently, the Ministry of Environment, Forest and Climate Change, published the Battery Waste Management Rules, 2022 to ensure environmentally sound management of waste batteries.

- Notification of these rules is a transformative step towards implementation of the announcement made by Prime Minister in his address to the Nation on Independence Day on 15th August, 2021 to promote Circular Economy in full earnest.

Key Highlights:

- New rules will replace Batteries (Management and Handling) Rules, 2001.

- The rules cover all types of batteries, viz. Electric Vehicle batteries, portable batteries, automotive batteries and industrial batteries.

Extended Producer Responsibility (EPR):

- The rules function based on the concept of Extended Producer Responsibility (EPR) where the producers (including importers) of batteries are responsible for collection and recycling/refurbishment of waste batteries and use of recovered materials from wastes into new batteries.

- EPR mandates that all waste batteries to be collected and sent for recycling/refurbishment, and its prohibits disposal in landfills and incineration. To meet the EPR obligations, producers may engage themselves or authorise any other entity for collection, recycling or refurbishment of waste batteries.

- The rules will enable setting up a mechanism and centralized online portal for exchange of EPR certificates between producers and recyclers/refurbishers to fulfil the obligations of producers.

Recycling/refurbishment:

- The rules promote setting up of new industries and entrepreneurship in collection and recycling/refurbishment of waste batteries.

- Mandating the minimum percentage of recovery of materials from waste batteries under the rules will bring new technologies and investment in recycling and refurbishment industry and create new business opportunities.

- Prescribing the use of certain amount of recycled materials in making of new batteries will reduce the dependency on new raw materials and save natural resources.

- Online registration & reporting, auditing, and committee for monitoring the implementation of rules and to take measures required for removal of difficulties are salient features of rules for ensuring effective implementation and compliance.

Polluter Pays Principle:

- On the principle of Polluter Pays Principle, environmental compensation will be imposed for non-fulfilment of Extended Producer Responsibility targets, responsibilities and obligations set out in the rules.

- The funds collected under environmental compensation shall be utilised in collection and refurbishing or recycling of uncollected and non-recycled waste batteries.

Rules, 2016.png)