Have household savings reduced? (GS Paper 3, Economy)

Why in news?

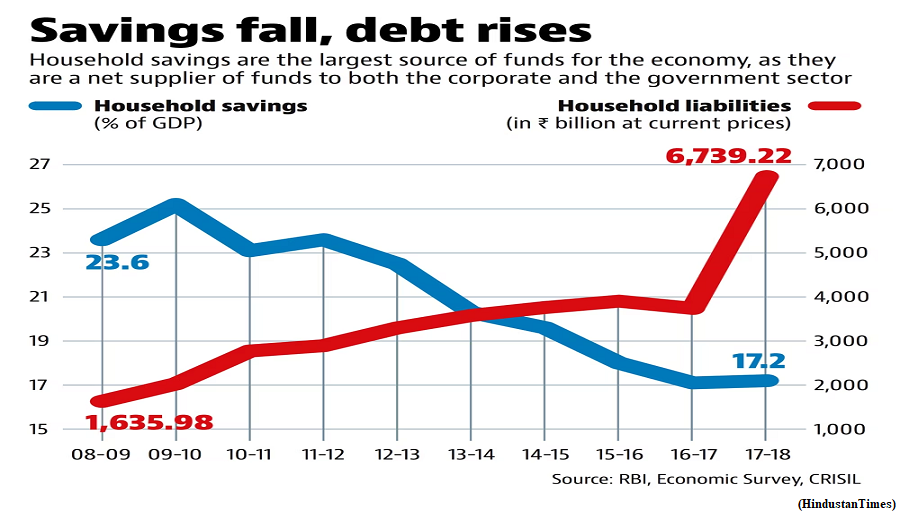

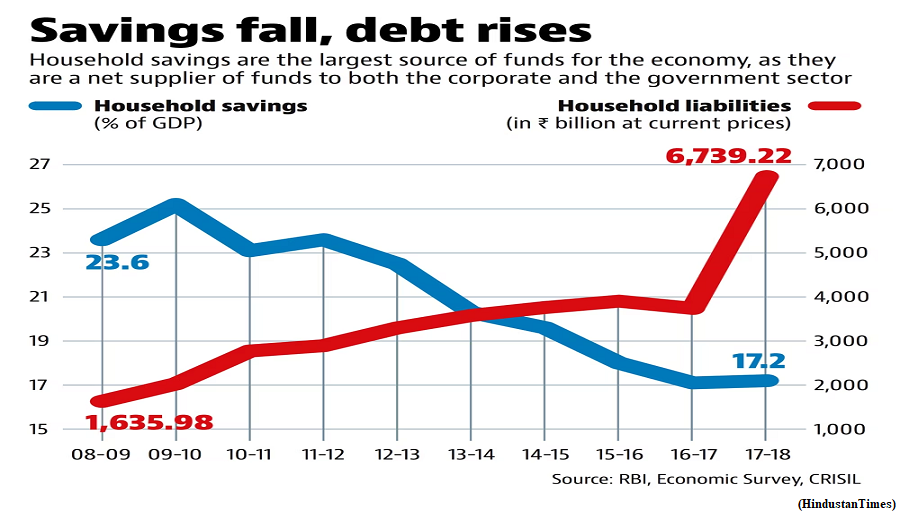

- The release of the Reserve Bank of India’s (RBI) Monthly Bulletin in September revealed that households’ net financial savings had fallen to 5.1% from 11.5% in 2020-21.

Details:

- Financial liabilities of households rose faster than their assets, with many writers highlighting this trend as an indication of rising indebtedness and increasing distress. The government, however, countered these claims.

- The Finance Ministry explained that while household financial savings may be reducing, it did not imply total savings were falling, since households took advantage of low interest rates after the pandemic to invest in assets such as vehicles, education and homes.

The optimistic claim:

- There is evidence to support the government’s narrative of a shift from financial to physical assets. Post-COVID, there has been an increase in household construction.

- Between 2020-21 and 2021-22, the construction sector was the fastest growing sector, growing at nearly 15% (when measured in 2011-12 prices), and 10% between 2021-22 and 2022-23. Only the trade, hotels, transport and communications sector grew faster in the latter period.

- Housing loans from Scheduled Commercial Banks (SCBs) grew at double-digit rates in all years between 2018-19 and 2022-23, with loans from housing finance companies growing almost 17 times between 2019-20 and 2022-23.

- Liabilities in other non-financial assets have also increased. Education and vehicle loans from SCBs increased significantly between 2021-22 and 2022-23, growing at 17% and around 25% respectively. This has led to significant changes in the composition of household savings.

- The share of physical assets is almost 60% of households’ total net savings, with the share of financial savings reducing from 39.6% in 2017-18 to 38.77% in 2021-22.

- That is, by taking advantage of the low interest rates set by the RBI in the wake of the pandemic, households may have increased their liabilities not to fuel consumption, but to purchase non-financial assets such as houses.

The pessimistic claim:

- Other evidence points to a slightly different picture. The fall in household net financial savings was driven largely by a rise in liabilities.

- Gross financial assets declined marginally as a share of GDP between 2021-22 and 2022-23 from 11.1% to 10.9%. Gross liabilities, remaining steady at roughly 3.8% of GDP between 2019-20 and 2021-22, increased to 5.8% of GDP in 2022-23.

- This rise in liabilities would not imply households have reduced savings if increasing loans financed the construction and purchase of homes. However, there is evidence to the contrary.

- While loans for housing, education and vehicles have no doubt increased, other components of personal loans have risen even faster.

- The share of housing loans in total non-food personal loans from SCBs has fallen from 51.08% in 2018-19 to 47.4% in 2022-23. The share of education loans has fallen from 3.32% to 2.37%, while vehicle loans have remained constant at around 12%.

- In contrast, outstanding credit card loans increased from 3.8% to 4.7% over this period, with loans against gold jewellery rising from 1.07% to 2.16%, and the category of “Other Personal Loans” showing the largest rise from 24% to 27.42%.

- The biggest contributor to the large rise in financial liabilities between 2021-22 and 2022-23 has been loans from non-banking institutions, which grew by almost ten times in just the last year, contributing to 32.1% of the total rise in financial liabilities over this period.

Conclusion:

- An examination of the data reveals that even though housing loans increased, other forms of loans which might possibly be used for consumption increased even faster.

- One could say that households are borrowing to maintain consumption in the face of income loss after COVID and high inflation. On the other hand, it could also be that pent-up demand during the pandemic is being realised in the form of debt-financed consumption, with households optimistic about future repayment.

- However, even if the optimistic narrative is true, there are grounds for concern. The U.S. Federal Reserve’s commitment to maintaining higher interest rates to combat inflation would have a knock-on effect on interest rates around the world.

- Rising interest rates in India would cause significant stresses for households to meet increasing liabilities. If households have invested in real estate, rising interest rates would curtail their consumption spending and reduce aggregate demand in the economy.

- If, however, the narrative of distress borrowing is true, households would be subjected to further stress if interest rates rise. Policy must be observant of the myriad pitfalls facing the Indian economy.

The largest climate action lawsuit against 32 countries

(GS Paper 3, Environment)

Why in news?

- September 27 marked the beginning of a historic legal battle in the climate action movement.

- Six young people from Portugal, aged 11 to 24, are suing 32 European governments (including the U.K., Russia and Turkey) at the European Court of Human Rights in France’s Strasbourg.

- The plaintiffs began arguing before 17 judges that their governments have failed to take sufficient action against the climate crisis, thus violating their human rights and discriminating against young people globally.

What is the lawsuit?

- Duarte Agostinho and Others versus Portugal and Others was filed in September 2020, in the aftermath of the wildfires that consumed Portugal’s Leiria in 2017. Over 60 people died, and 20,000 hectares of forests were lost.

- The recent spate of heatwaves and fires across Greece, Canada and other parts of Europe served as reminders that every increment beyond the 1.5°C temperature threshold would be catastrophic, intensifying “multiple and concurrent hazards.

- The Portuguese youths claim that European nations have faltered in their climate emission goals, blowing past their global carbon budgets consistent with the Paris Agreement target of limiting global warming under 1.5°C.

- The nations have thus violated people’s fundamental rights protected under the European Convention on Human Rights, including the right to life, the right to be free from inhuman or degrading treatment, the right to privacy and family life and the right to be free from discrimination.

Emission reduction targets:

- The European Scientific Advisory Board on Climate Change (ESABCC), a body which provides scientific advice to EU countries, said countries will have to target an emissions reduction of 75% below 1990 levels (as opposed to the EU’s current 55%).

- Under some of these principles, the EU has already exhausted its fair share of the global emissions budget and the European countries have overstated their carbon budget claims. The EU at present is the sixth largest emitter with 7.2 tonnes of CO2 per capita, while the world averages 6.3 tonnes per capita.

- UNICEF has dubbed the climate crisis as a “child rights crisis”, as unhindered carbon emissions and extreme weather threaten access to education, health, nutrition and the future.

- Research concurs, air pollution is already linked to poor birth outcomes and increased risk of cardiovascular and respiratory diseases. Heat waves are triggering mental health issues.

How have governments responded?

- It comes down to cause and effect: countries so far have rejected any relationship between climate change and its impact on human health.

- For instance, Greece, in its submissions, maintained that the effects of climate change “do not seem to directly affect human life or human health.” This is even as the country witnessed devastating wildfires earlier this year and torrential rain and flooding in September.

- The Portuguese and Irish governments have dismissed these concerns as ‘future fears’, arguing that there is no evidence to show climate change poses an immediate risk to their lives.

How government agencies use commercial spyware to target opponents

(GS Paper 3, Science and Technology)

Why in news?

- Between May and September, former Egyptian MP Ahmed Eltantawy was targeted with Cytrox’s Predator spyware sent via links on SMS and WhatsApp. Apple has since released an update for its products fixing the bug used in the attack.

- The attack on Mr. Eltantawy came after he publicly stated plans to run for President in the 2024 Egyptian elections, which is especially concerning since Egypt is a known customer of Cytrox’s Predator spyware.

Pegasus Project:

- In 2021, investigations under the Pegasus Project revealed the massive scale of potential targets of spyware.

- Reports shared that victims of the spyware attacks were in India, Azerbaijan, Bahrain, Hungary, Kazakhstan, Mexico, Morocco, Rwanda, Saudi Arabia and the UAE.

- The Pegasus spyware was also reportedly used by the Kingdom of Saudi Arabia to target journalist Jamal Khashoggi’s wife months before his death.

What is spyware?

- Spyware is loosely defined as malicious software designed to enter a device, gather sensitive data, and forward it to a third party without the user’s consent.

- While spyware may be used for commercial purposes like advertising, malicious spyware is used to profit from data stolen from a victim’s device. Spyware is broadly categorised as trojan spyware, adware, tracking cookie, and system monitors.

- While each type of spyware gathers data for the author, system monitors and adware are more harmful as they may make modifications to a device’s software and expose the device to further threats.

What is commercial spyware?

- Malicious spyware has been around since the 1990s. Earlier iterations of spyware were limited to being used by criminals to steal passwords or financial information.

- However, opportunities for governments and law enforcement agencies to use spyware as part of legal investigations led to the development of commercial spyware.

- Commercial spyware mainly targets mobile platforms and can legitimately be used against criminals and terrorists. However, the lack of global regulations for companies developing spyware has led to their use by authoritarian governments to spy on political opponents.

How are the devices targeted?

- Investigations by Citizen Lab and Google’s Threat Analysis Group (TAG) revealed that spyware on the former Egyptian MP’s device was delivered via network injection from a device located physically inside Egypt.

- His device was infected when he visited certain websites without ‘HTTPS’ from his phone using his Vodafone Egypt mobile data connection. When he visited these sites, his device was silently redirected to a website, that matches the fingerprint for Cytrox’s Predator spyware — this is where his device was injected with the spyware.

- In India, the Pegasus spyware was part of a $2-billion “package of sophisticated weapons and intelligence gear” transaction between India and Israel after Narendra Modi became the first Indian Prime Minister to visit Israel.

- The spyware in India was used against at least 40 journalists, Cabinet Ministers, and holders of constitutional positions. The spyware was delivered to the victim’s phones by exploiting zero-day vulnerabilities, which means even the device manufacturer was unaware of these exploits.

Is the use of spyware increasing?

- Between 2011 and 2023, at least 74 governments contracted with commercial firms to obtain spyware or digital forensics technology.

- Autocratic regimes are more likely to purchase commercial spyware or digital forensics than democracies, 44 regimes classified as closed autocracies or electoral autocracies are known to have procured targeted surveillance technologies.

- Earlier in 2023, an Indian defence agency was reportedly purchasing equipment from an Israeli spyware firm that is being billed as a potential Pegasus alternative. The firm in question is Cognyte Software Ltd, which faces a class action lawsuit in the U.S. from investors.

- In 2022, the FBI in the U.S. had bought a version of the Pegasus spyware and that Mexican authorities had deployed NSO products against journalists and political dissidents. Similar uses have also been reported in the UAE and Saudi Arabia.

How have tech companies reacted?

- Tech giants including Meta, Google, and Apple have taken concrete steps to address the problem of commercial spyware firms exploiting bugs in their software.

- Apple with its iOS 16 also released a ‘Lockdown Mode’, which the company called an “extreme protection” designed for high-risk individuals. While the Lockdown Mode in Apple’s software limits the device’s functionality, it has proven to be a viable option to protect against spyware attacks.

- Meta-owned WhatsApp has gone as far as pursuing a lawsuit accusing Israel’s NSO Group of exploiting a bug in its software. The lawsuit filed in 2019 seeks an injunction and damages from the NSO Group.

- WhatsApp has alleged that the spyware firm accessed its servers without permission six months prior to installing the Pegasus software on victim’s mobile devices.