Virtual Autopsy (GS Paper 3, Science and Tech)

Context:

- After battling for life for more than 40 days, recently comedian Raju Srivastava breathed his last at Delhi’s All India Institute of Medical Sciences (AIIMS), Delhi.

- His post-mortem was performed using a novel technology known as “virtual autopsy”. The entire procedure took around “15 to 20 minutes”.

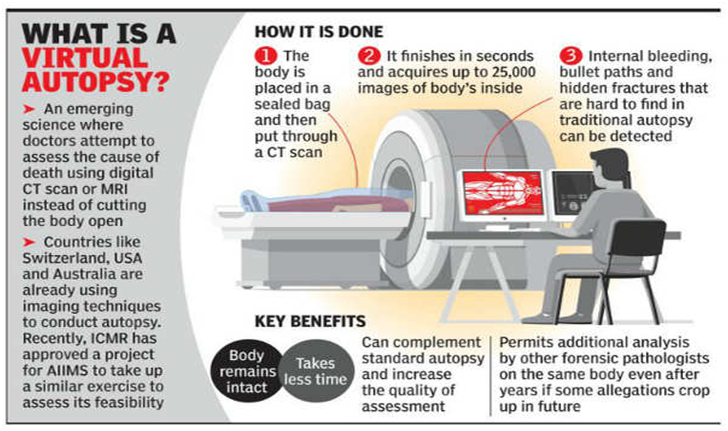

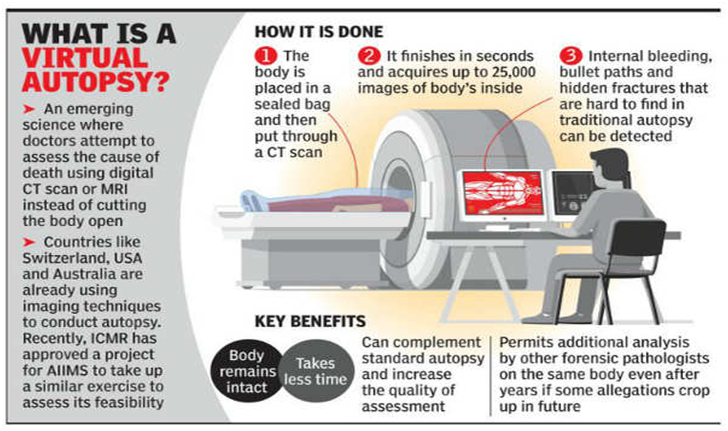

What is a virtual autopsy?

- A post-mortem or autopsy is a highly specialised surgical procedure that consists of a thorough examination of a corpse to determine the cause and manner of death and to evaluate any disease or injury that may be present.

- Virtual autopsy or virtopsy employs imaging methods that are also used in clinical medicine such as computed tomography (CT), magnetic resonance imaging (MRI),etc for autopsy and to find the cause of the death. It does not necessitate dissection of the body.

How is a virtual autopsy conducted?

- A CT or MRI is used to scan the body the same way it is done when a person is alive. Under this process, the body is packed in a bag and put in the CT machine. Images of the internal organs are captured within minutes which can then be analysed by forensic experts.

- Doctors can also use radiation to examine the inside of the body and reach a conclusion about the cause of death.

What are the benefits of a virtual autopsy?

- A regular post-mortem can take up to three hours. It can also go up to three days, depending on the complexity of the case and the availability of experts to conduct the procedure.

- However, a virtual autopsy can be conducted within less than 30 minutes.

- This process saves both time and manpower. It is also cost-effective.

- Apart from benefits to medical professionals, a virtual autopsy has many emotional and ethical advantages. Many religions and cultures are against mutilating the body for the sake of autopsy.

Disadvantages:

- Though virtopsy has its advantages, it has a disadvantage that the physiological senses of an anatomical pathologist like smell, texture, and colour are restricted as there is no direct contact with the dead body of the victim.

- Also, the main disadvantage is the feasibility of using these high-technology imaging devices in less developed countries.

When did India start doing virtual autopsies?

- In March 2021, AIIMS decided to conduct this procedure whenever possible. It was the first medical institution in south and southeast Asia to have the facility.

- AIIMS set up the virtual autopsy lab with the Indian Council of Medical Research (ICMR), the apex body in India that promotes biomedical research.

Where else is virtual autopsy practised?

- Virtual autopsy first began in Sweden. Now, this technique is used in the United States, the United Kingdom, Australia, Japan, Switzerland and other European countries.

- “Post-post-mortem” MRI service for “selected non-suspicious deaths” was introduced in Manchester, the UK in the 1990s.

- The Jewish and Muslim communities demanded a non-invasive procedure.

Electoral Bond Scheme & the challenges to it in Supreme Court

(GS Paper 2, Polity and Governance)

Why in news?

- The Supreme Court is expected to hear the petition filed by the Association for Democratic Reforms (ADR) challenging the Centre’s electoral bonds Scheme soon. The plea has been pending since 2017.

- The main case challenging the constitutionality of the scheme is yet to be heard and ADR’s plea appeared on the cause list of Supreme Court.

- The scheme has generated much debate since its announcement in 2017, inviting concerns from the Election Commission, Reserve Bank of India, Parliament, and civil society.

What is the electoral bonds scheme?

- Electoral bonds are money instruments like promissory notes that can be bought by companies and individuals in India from the State Bank of India (SBI) and donated to a political party, which can then encash these bonds.

- The electoral bond does not bear the name of the donor and is, in effect, anonymous.

- The scheme was first announced by former Finance Minister ArunJaitley during the 2017 budget session and was notified in January 2018.

- Under the scheme, bonds are available for purchase at any SBI branch in multiples of ₹1,000, ₹10,000, ₹1 lakh, ₹10 lakh and ₹1 crore and can be bought through a KYC-compliant account. There is no limit on the number of electoral bonds that a person or company can purchase.

Eligibility:

- Every party registered under section 29A of the Representation of the Peoples Act, 1951 (43 of 1951) and having secured at least one per cent of the votes polled in the most recent Lok Sabha or State election has been allotted a verified account by the Election Commission of India. The donor can donate the bond to a party of their choice, which can cash it within 15 days, only through the allotted account.

- The bonds go for sale in 10-day windows in the beginning of every quarter, i.e. in January, April, July and October, besides an additional 30-day period specified by the Central Government during Lok Sabha election years.

- Electoral bonds are not the only way in which parties now receive donations. They can also receive cash donations of less than ₹2,000 from anonymous sources through cheque or by digital mode, in addition to electoral bonds.

What are the pleas challenging the scheme in the Supreme Court?

- There are two petitions challenging the scheme, one jointly filed in 2017 by ADR and non-profit Common Cause, and another filed in 2018 by the Communist Party of India (Marxist) both largely asking for the same relief.

- The Election Commission of India (ECI), which was a respondent to the petition, filed a counter-affidavit questioning the electoral bonds scheme in its current form.

Grounds of petition:

Concerns about electoral corruption:

- They argued that the amendments made to multiple Acts to make way for the electoral bonds scheme would open the “floodgates” to unlimited political donations and anonymous funding of political parties by Indian and foreign companies, “legitimizing electoral corruption at a huge scale”, and would have “serious repercussions on the Indian democracy”.

- The Election Commission submitted that contrary to the government’s claims, donations received through electoral bonds would cause a “serious impact” on transparency.

Amendments to Finance Acts:

- In order to bring in the scheme, the Centre had made multiple amendments by way of two Finance Acts— Finance Act, 2017 and Finance Act, 2016, both passed as money bills (not necessitating the oversight of the Rajya Sabha).

- The petitioners challenged the amendments as being “unconstitutional”, “violative of doctrines of separation of powers” and violative of some fundamental rights. The ECI said that the amendments would pump in black money for political funding.

Amendment to the Representation of the People Act:

- The government amended Section 29C of the Representation of the People Act, 1951, effectively exempting political parties from informing the ECI about the details of contributions made to them through electoral bonds.

- ADR argued that this would impact transparency and keep citizens from vital information about how much contribution a political party received and through what source, as the source or donor is anonymous under electoral bonds.

- The ECI said that would prevent it from ascertaining whether the donations were received illegally from government companies or foreign sources, calling it a “retrograde step” for transparency.

Companies Act amendment:

- The petitioners also objected to the amendment to the Companies Act 2013 such that no companies are required to give details of political contributions in their annual profit and loss accounts. The petitioners argued that this would increase “opacity” in political funding and the danger of “quid pro quo” in return for benefits passed to such companies by political parties.

- They also opposed the removal of the cap or ceiling for companies to make donations. Prior to 2017, companies were only permitted to make political donations of up to 7.5 % of net profits in the previous three years.

- This change, ADR argued, would allow even loss-making companies to make donations and result in the creation of unscrupulous companies only to route funds to political parties. The ECI too flagged similar concerns about shell companies.

Amendment to the FCRA Act:

- The petitioner opposed an amendment to the Foreign Contribution Regulation Act, 2010 (FCRA), allowing foreign companies with subsidiaries in India to fund Indian political parties, stating that it would expose “Indian politics and democracy to international lobbyists” having their own agendas.

- The ECI too flagged concerns about this, saying it would invite foreign corporate powers to influence Indian politics.

Income Tax Act amendment:

- The ECI also raised concerns about the amendment to the Income Tax Act 1961, allowing anonymous donations only less than Rs. 20,000.

- The poll panel said that due to this, many political parties had started “reporting a major portion of the donations received as being less than the prescribed limit of Rs. 20,000”.

Infringing the “Right to Know”:

- The petitioner ADR argued that the amendments infringed upon the citizen’s fundamental ‘Right to Know’, which various Supreme Court judgements have interpreted as part of the freedom of speech and expression.

- The plea said that the opacity and anonymity made political parties more “unanswerable and unaccountable” to the citizens at large.

Derailing of ECI guidelines:

- The ECI said that the amendments derailed its 2014 guidelines on disclosure of expenditure and contributions received by political parties.

- ECI had “time and again voiced the importance of the declaration of donations received by political parties” for “better transparency and accountability in the election process”.

What did the Supreme Court say in its previous two orders?

- The petitioners approached the Supreme Court before the 2019 Lok Sabha elections, seeking interim relief in the form of either a stay on the issuance of electoral bonds or a disclosure of the names of the donors to ensure transparency in the poll process.

- The government, meanwhile, argued that the amendments were to rid the political funding system of black money, adding that the government “must be allowed a free hand to implement measures” and it would be premature for the court to render an opinion or pass an order.

2019 interim order:

- In its interim order on April 12, 2019, a Bench led by former Chief Justice of India RanjanGogoi said the issue of electoral bonds was a "weighty” issue having a “tremendous bearing on the sanctity of the electoral process in the country,” and that it required an in-depth hearing which could not be done in the limited timeframe.

- The Bench wanted to ensure that any interim arrangement did “not tilt the balance in favour of either of the parties” but at the same time provided safeguards against the competing claims of the petitioners and respondents.

- The Court directed political parties to provide complete information to the ECI in sealed covers on every single donor and contribution received by them till that date through electoral bonds.

2021 interim order:

- In March 2021, the petitioner, through advocate Prashant Bhushan, again approached the Court asking for a stay on the scheme before Assembly elections in multiple States, but the Bench led by former CJI N.V. Ramana refused the same.

- The Bench contended that just a little effort was required to pierce the veil of anonymity around electoral bonds.

- As for concerns related to the repurchase of bonds from the first buyer, also expressed in RBI communications, the court said that the bond was not tradable and asked why the first buyers would sell the bond to get black money in return for white.

Dvorak technique

(GS Paper 3, Science and Tech)

Why in news?

- Recently, the American meteorologist Vernon Dvorak passed away.

- In the era of advanced satellite technology, Machine Learning (ML), Artificial Intelligence (AI), Dvorak technique, named after him, continues to be widely relied upon by forecasters till date.

Who was Vernon Dvorak?

- Dvorak was an American meteorologist best credited for developing the Dvorak technique in the early 1970s.

- He was bestowed with the United States Department of Commerce Meritorious Service award in 1972. In 2002, he received a Special Lifetime Achievement Award from the National Weather Association.

Advanced Dvorak Technique:

- The technique has been upgraded multiple times since then, and after a recent software update in May 2022, it has been named the Advanced Dvorak Technique (ADT), coined by the National Hurricane Centre of the National Oceanic and Atmospheric Administration (NOAA).

- The updated technique would improve the tropical storm forecasts by many folds as they would have access to sharper and detailed images than ever before.

What is the Dvorak technique?

- It was first developed in 1969 and tested for observing storms in the northwest Pacific Ocean.

- Forecasters used the available satellite images obtained from polar orbiting satellites to examine the features of the developing tropical storms (hurricanes, cyclones and typhoons).

- During day time, images in the visible spectrum were used while at night, the ocean would be observed using infrared images.

- The Dvorak technique was a cloud pattern recognition technique based on a concept model of the development and decay of the tropical cyclone.

Cyclone intensity:

- Through this statistical technique, scientists are able to measure the cyclone’s convective cloud pattern; curved bands, eye and central dense or cold region and shear. It is the Dvorak technique which gives the best estimates of the cyclone intensity, a vital component while issuing weather warnings.

- This tool cannot help make any predictions, measure wind or pressure or any other meteorological parameters associated with the cyclone.

- But it is a guide to estimate the storm’s intensity and possible intensification which is crucial for local administration in planning evacuation measures of coastal or other nearby residents.

- He had also presented the wind speed and associated category of the tropical cyclone, making it a near-perfect tool for the operational cyclone forecasters.

Why is technique still widely in use?

- Today, there continues to be an improved network of land-based meteorological observations, either in the form of taking manual observations, installing automatic weather stations or automatic rain gauges. On the other hand, ocean observations still remain limited.

- There are many vast regions across the four oceans that have not been fully examined with meteorological instruments.

- Ocean observations are mostly taken by deploying buoys or dedicated ships, but the number of observations from the seas is still not sufficient across the world.

- That is why meteorologists have had to depend more on satellite-based imageries, and combine it with the available ocean-data at the time of forecasting the intensity and wind speed of the tropical cyclones.

Way Forward:

- Even in the present day, when forecasters have access to several state-of-the-art tools like model guidance, animations, artificial intelligence, machine learning and satellite technology, it is the advanced versions of the 50-year-old technique that continues to be widely used.

- It has saved the lives of millions of people across the world and will continue to do so.

Defence ministry inks deal for dual role Surface-to-Surface BrahMos missile

(GS Paper 3, Defence)

Why in news?

- Providing impetus to “Aatmanirbharta” (self-reliance) in defence production, the Ministry of Defence (MoD) signed a contract with the Indo-Russian joint venture (JV) – BrahMos Aerospace Private Limited (BAPL)for buying the latest version of the BrahMos missile for its newest warships.

- The surface-to-surface BrahMos missiles were bought for “an overall approximate cost of ₹1,700 crore under the Buy-Indian category.

Salient Features:

New Range capability:

- So far, BrahMos missiles have had a range of 295 kilometres, to adhere to the parameters of the Missile Technology Control Regime (MTCR), which restricts missile sales involving a non-MTCR country to a maximum range of 300 km.

- However, with India’s admission into the MTCR, a new generation of BrahMos missiles, with ranges of 400 km and more, can legitimately be built by the Indo-Russian JV.

- These new BrahMos missiles will be “dual-role capable”, announced the Navy, which means that its warships can fire them at targets on land, as well as at enemy warships.

BrahMos Aerospace JV:

- BrahMos Aerospace JV was established through an Indo-Russian Inter-Government Agreement (IGA) in February 1998 for designing, developing, producing and marketing the BrahMos supersonic cruise missile.

- The JV’s share capital of $250 million was contributed by India and Russia in the ratio of 50.5 per cent and 49.5 per cent, respectively.

- The share capital was enhanced by $50 million to pay for developing the aircraft version of the missile, which is fired from the Sukhoi-30MKI fighter.

- Additionally, the Defence R&D Organisation also contributed Rs 370 crore towards the infrastructure, technologies and production facilities for building the missile system.

Way Forward:

- Post Russia’s invasion of Ukraine in February 2022 and the Chinese aggression on India’s eastern Ladakh theatre in June 2020, where demilitarization is still taking place, the India’s focus on self-reliance in defence manufacturing and being alert and prepared to take on aggressive opponents at all times has been one of the priorities.

- These missiles are going to significantly enhance the operational capability of Indian Navy (IN) fleet assets.