Ministry of Education releases All India Survey on Higher Education (AISHE) 2020-2021 (GS Paper 2, Education)

Why in news?

- The Ministry of Education, Government of India has released All India Survey on Higher Education (AISHE) 2020-2021.

About AISHE:

- The Ministry has been conducting All India Survey on Higher Education (AISHE) since 2011, covering all higher educational institutions located in Indian Territory and imparting higher education in the country.

- The survey collects detailed information on different parameters such as student enrollment, teacher’s data, infrastructural information, financial information etc.

- For the first time, in AISHE 2020-21, HEIs have filled data using entirely online data collection platform through the Web Data Capture Format (DCF) developed by Department of Higher Education through the National Informatics Centre (NIC).

Following are the key highlights of the survey:

Student Enrollment:

- The total enrollment in higher education has increased to nearly 4.14 crore in 2020-21 from 3.85 crore in 2019-20. Since 2014-15, there has been an increase of around 72 Lakh in the enrolment (21%).

- The Female enrolment has increased to 2.01 crore from 1.88 crore in 2019-20. There has been an increase of around 44 Lakh (28%) since 2014-15.

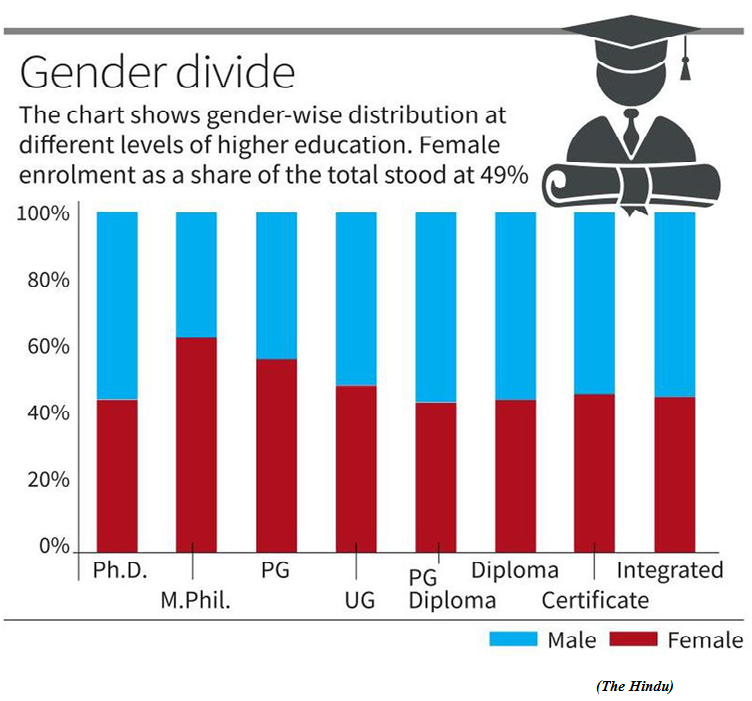

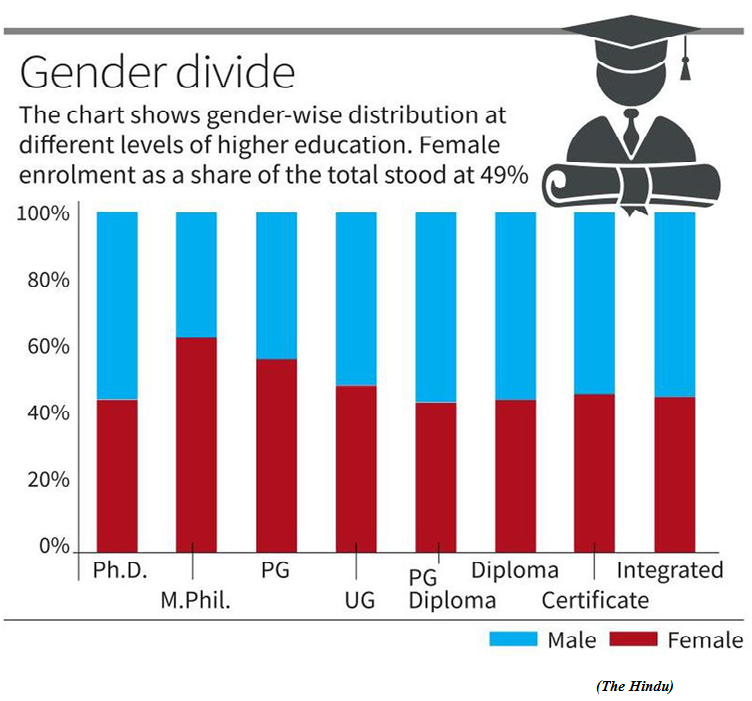

- The percentage of female enrolment to total enrolment has increased from 45% in 2014-15 to around 49% in 2020-21.

- As per 2011 population projections for 18-23 years age group, GER has increased to 27.3 from 25.6 in 2019-20.

- Female GER has overtaken Male GER since 2017-18. Gender Parity Index (GPI), the ratio of female GER to male GER, has increased from 1 in 2017-18 to 1.05 in 2020-21.

SC/ST/OBCs

- The enrolment of SC students is 58.95 Lakh as compared to 56.57 Lakh in 2019-20 and 46.06 Lakh in 2014-15.

- The enrolment of ST students has increased to 24.1 Lakh in 2020-21 from 21.6 Lakh in 2019-20 and 16.41 Lakh in 2014-15.

- The average annual enrolment of ST students has increased to around 1 Lakh during the period 2014- 15 to 2020-21, from around 75,000 during the period 2007-08 to 2014-15.

- Enrolment of OBC students has also increased by 6 Lakh to 1.48 crore in 2020-21, from 1.42 crore in 2019-20. There is a notable increase in OBC student enrolment since 2014-15 of around 36 Lakh (32%).

State-wise:

- The total Student Enrolment in North East States is 12.06 Lakh in 2020-21 as compared to 9.36 Lakh in 2014-15.

- The female enrolment in North East States is 6.14 lakh in 2020-21, higher than the male enrolment of 5.92 lakh [For every 100 male students, there are 104 female students in NER]. The female enrolment outnumbered male enrolment for first time in 2018-19, and the trend continues.

- The enrolment in Distance Education is 45.71 Lakh (with 20.9 Lakh Female), an increase of around 7% since 2019-20 and 20% since 2014-15.

- Uttar Pradesh, Maharashtra, Tamil Nadu, Madhya Pradesh, Karnataka and Rajasthan are the top 6 States in terms of number of student enrolled.

UG/PG

- As per response in AISHE 2020-21, about 79.06% of the total students are enrolled in undergraduate level courses and 11.5% are enrolled in postgraduate level courses.

- Among Disciplines at undergraduate level, enrollment is highest in Arts (33.5%), followed by Science (15.5%), Commerce (13.9%) and Engineering & Technology (11.9%).

- Among streams at postgraduate level, maximum students are enrolled in Social Science (20.56%) followed by science (14.83%).

- Of the total enrolment, 55.5 Lakh students are enrolled in Science Stream, with female students (29.5 Lakh) out numbering male students (26 Lakh).

- Government Universities (59% of total) contribute towards 73.1% of the enrolment. Government Colleges (21.4% of total) contribute towards 34.5% of the enrolment.

- The enrolment in Institute of National Importance (INIs) has increased by nearly 61% during the period 2014-15 to 2020-21.

- Enrolment has increased in 2020-21 compared to 2014-15 in the Specialized Universities relating to Defence, Sanskrit, Biotechnology, Forensics, Design, Sports etc.

- The total number of pass-outs has increased to 95.4 Lakh in 2020-21 as against 94 Lakh in 2019-20.

Number of Institutions:

- The total number of Universities / University like institutions registered is 1,113, Colleges 43,796 and Standalone Institutions 11,296.

- During 2020-21, the number of Universities has increased by 70, and the number of Colleges has increased by 1,453.

- Since 2014-15, there has been increase of 353 Universities (46.4%).

- The Institutes of National Importance (INIs) have almost doubled from 75 in 2014-15 to 149 in 2020-21.

- 191 new Higher Education Institutions have been established in North Eastern States since 2014-15.

- Highest number of Universities is in Rajasthan (92), Uttar Pradesh (84) and Gujarat (83).

- During 2014-15 to 2020-21, on average, 59 Universities have been added annually. This was about 50 during 2007-08 to 2014-15.

- 17 Universities (of which 14 are State Public) and 4,375 Colleges are exclusively for women.

- The College Density, the number of colleges per lakh eligible population (population in the age-group 18-23 years) has been 31. This was 27 in 2014-15.

- States with Highest college density: Karnataka (62), Telangana (53), Kerala (50), Himachal Pradesh (50), Andhra Pradesh (49),Uttarakhand (40), Rajasthan (40), Tamilnadu (40).

- Top 8 Districts with Highest number of Colleges: Bangalore Urban (1058), Jaipur (671), Hyderabad (488), Pune (466), Prayagraj (374), Rangareddy (345), Bhopal (327) and Nagpur (318).

- Uttar Pradesh, Maharashtra, Karnataka, Rajasthan, Tamil Nadu, Madhya Pradesh, Andhra Pradesh,Gujarat are top 8 States in terms of number of colleges.

Faculty:

- The total number of faculty/teachers are 15,51,070 of which about 57.1% are male and 42.9% are female.

- The female per 100 male faculty has improved to 75 in 2020-21 from 74 in 2019-20 and 63 in 2014-15.

Command postings for women officers in the Army

(GS Paper 3, Defence)

Why in news?

- The Army has stated that the process for selection of women officers to command assignments in the rank of Colonel, a major step towards bringing them at par with their male counterparts, has been conducted.

- This flows from the Supreme Court judgment of 2020 upholding an earlier judgment granting permanent commission (PC) as well as command postings to women officers in all arms and services other than combat.

What is the process?

- The Army has conducted a Women Officers Special No 3 Selection Board for promotion from the rank of Lieutenant Colonel to Colonel.

- A total of 244 women officers are considered for promotion.

- Following judicial intervention, the Army has granted PC to women officers at par with their male counterparts in all Arms and Services other than combat arms which are infantry, mechanised infantry and armoured.

- Additionally, it was announced that women officers would soon be inducted into the Corps of Artillery as well.

What do command postings mean?

- Apart from medical and dental streams, since 2008 the Army had granted PC for women officers in the Education Corps and Judge Advocate General (JAG) branches where they already go to the rank of Colonel.

- However, they are largely administrative appointments unlike the regular arms and services where Colonels command officers and men and lead them from the front.

- A Commanding Officer (CO) is a very coveted position in the Army and therein lies its significance in it being opened up for women. In the past, women were recruited in various arms and services only as short service commissions, which meant they would have to leave service after 14 years, much short of the pensionable service of 20 years.

- In a landmark judgment in the Babita Puniya case in February 2020, the Supreme Court directed that women officers in the Army be granted PC as well as command postings in all services other than combat.

- Further, on March 25, 2021 the Supreme Court in Lt. Col. Nitisha versus Union of India held that the Army’s selective evaluation process discriminated against and disproportionately affected women officers seeking PC.

- With reduction in the age profile of COs over the years, an officer now becomes a Colonel after about 16-18 years of service.

What is the way forward?

- All women officers who were granted PC are undergoing special training courses and assignments to empower them for higher leadership roles.

- For the first time last year, five Women Officers (WOs) have cleared the Defence Services Staff Course and Defence Services Technical Staff Course Exam, which is held annually in the month of September.

- The five WOs will undergo a one year course which will give them adequate weightage while being considered for command appointments.

- These developments will allow women officers to assume challenging leadership roles, akin to their male counterparts, and also to go further up the rank structure.

- Women are being inducted in the ranks of sailors by the Navy under the Agnipath scheme and will soon be deployed onboard warships while the Army has inducted women as soldiers in the Corps of Military Police.

Revisit the tax treatment of tobacco products

(GS Paper 3, Economy)

Context:

- Adam Smith, in his famous work ‘The Wealth of Nations’, argued that commodities such as sugar, rum and tobacco, though not necessary for life, are widely consumed, and thus good candidates for taxation.

- Research in India and around the world supports the use of taxes to regulate tobacco consumption.

- However, in India, tobacco taxes have not increased significantly since the implementation of the Goods and Services Taxation (GST) over five years ago, making these products increasingly affordable, as recent studies show.

Economic Impact:

- In 2017, the economic burden and health-care expenses due to tobacco use and second-hand smoke exposure amounted to ₹2,340 billion, or 1.4% of GDP while India’s average annual tobacco tax revenue stands at only ₹537.5 billion.

- Despite the government’s goal of making India a $5 trillion economy, the increasing affordability of tobacco poses a threat to this vision and could harm GDP growth.

- Tobacco use is also the cause for nearly 3,500 deaths in India every day, which impacts human capital and GDP growth in a negative way.

The issue is with the tax system:

- The current GST system for tobacco taxation in India has features that are hindering efforts in regulating consumption. One issue is the overuse of ad valorem taxes, which are not effective in reducing consumption. Many countries use a specific or mixed tax system for harmful products.

- The GST system in India relies more on ad valorem taxes than the pre-GST system, which primarily used specific excise taxes. Many countries with a GST or value-added tax (VAT) also apply an excise tax on tobacco products.

- In India, the share of central excise duty in total tobacco taxes decreased substantially from pre-GST to post-GST for cigarettes (54% to 8%), bidis (17% to 1%), and smokeless tobacco (59% to 11%).

- A large part of the compensation cess as well as the National Calamity Contingent Duty, or NCCD (it is levied as a duty of excise on certain manufactured goods specified under the Seventh Schedule of the Finance Act, 2001) currently applied on tobacco products is specific.

- If specific taxes are not revised regularly to adjust for the inflation, they lose their value. Inflation indexing should be made mandatory for any specific tax rates applied on tobacco products.

Discrepancies in product taxation:

- There is a large discrepancy in taxation between tobacco products. Despite cigarettes accounting for only 15% of tobacco users, they generate 80% or more of tobacco taxes.

- Bidis and smokeless tobacco have low taxes, encouraging consumption. Taxes should be made more consistent across all tobacco products, as none is more or less harmful than the others.

- The main principle behind tobacco taxation should be in protecting public health. Notably, bidis are the only tobacco products without a compensation cess under GST, despite being just as harmful as cigarettes. This lack of a cess on bidis has no public health rationale.

- The GST rates on certain smokeless tobacco ingredients such as tobacco leaves, tendu leaves, betel leaves, areca nuts, etc. have either zero or 5%-18% GST. It is important that all products that are exclusively used for tobacco making are brought under the uniform 28% GST slab.

- Smokeless tobacco products in India are taxed ineffectively due to their small retail pack size (often 1/2 gram or less) which keeps the price low.

- To standardise and increase the retail price, mandatory standardised packing should be implemented for smokeless tobacco pouches (at least 50 g-100 g). This will also make it easier to implement graphic health warnings on the packaging.

- GST currently exempts small businesses with less than ₹40 lakh annual turnover. Many smokeless tobacco and bidi manufacturers operate in the informal sector, which reduces the tax base on these products.

Way Forward:

- After GST, States can no longer raise taxes on tobacco, which hinders their ability to increase revenue and regulate consumption. While a uniform tax across the country is good, not increasing it at the national level at regular intervals harms public health.

- It is cause for concern that while most countries regularly increase taxes on tobacco products to make them less affordable, India has not increased taxes on any tobacco products in over five years. This may undo much of the progress seen in a 17% reduction in tobacco use from 2009-10 to 2016-17.

- Both the GST Council and the Union Budget should take the opportunity to significantly increase taxes on all tobacco products, including bidis, cigarettes, and smokeless tobacco, through hikes in excise duties or compensation cess.