Eight former Navy officers get death penalty in Qatar (GS Paper 2, International Relation)

Why in news?

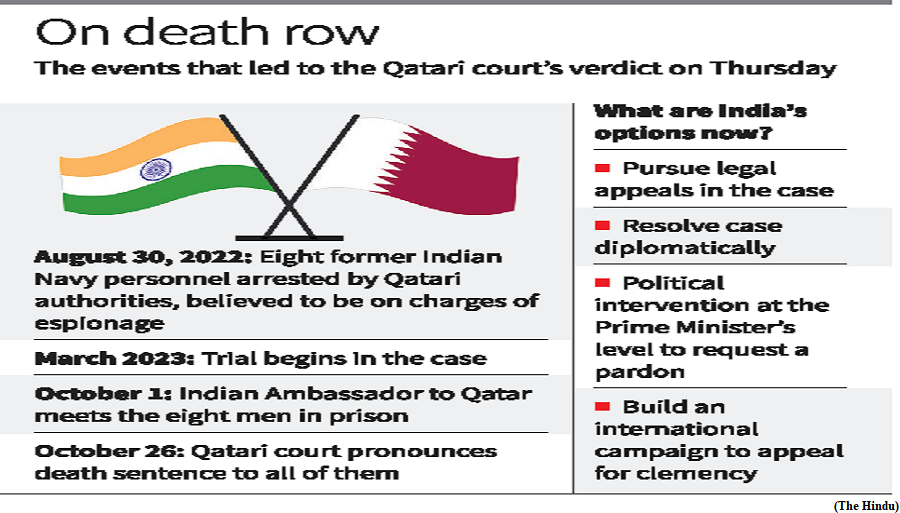

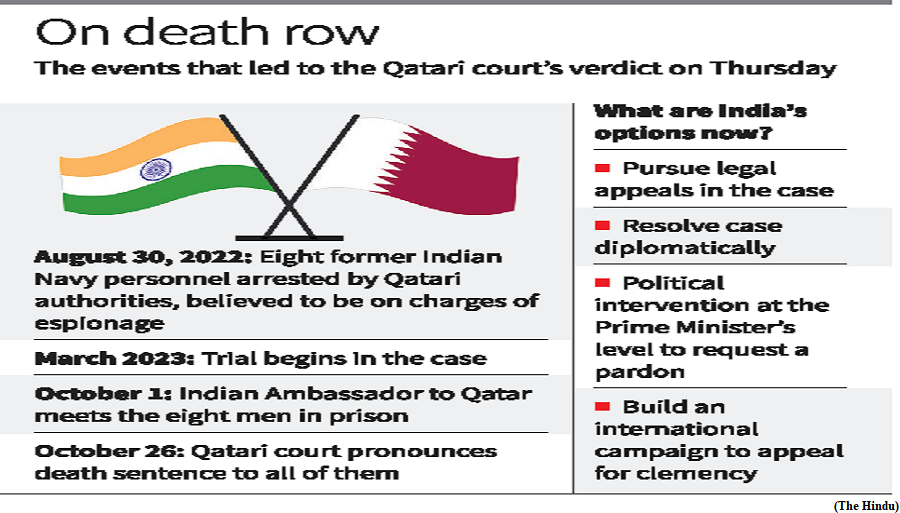

- Eight former Indian Navy personnel, who had been employed by a company in Doha, were handed the death penalty by a local court in Doha in an alleged case of espionage.

- The Indian government expressed shock at the verdict, and said all legal options were being explored.

Details:

- The eight men: Captain Navtej Singh Gill, Captain Saurabh Vashisht, Commander Purnendu Tiwari, Captain Birendra Kumar Verma, Commander Sugunakar Pakala, Commander Sanjeev Gupta, Commander Amit Nagpal and Sailor Ragesh have been in the custody of Qatari authorities since August 2022.

- The Court of First Instance of Qatar passed the judgment against them.

What is the case against these officials?

- The Indian nationals were employed by Dahra Global Technologies and Consultant Services in Doha, and were allegedly accused of breaching sensitive secrets. They were reportedly involved in training various security-related service providers of the State of Qatar.

- The company was also involved in producing high- tech Italian-origin submarines that are known for stealth capabilities.

- The owner of the firm, reportedly a retired squadron leader of the Royal Omani Air Force, was arrested along with the Indian officers, but he was released in November 2022.

- The first trial in the case was held in March 2022, followed by another in June. The men were granted consular access on multiple occasions and the Indian ambassador to Qatar met them as recently as October 1.

- Both sides, however, have maintained a veil of secrecy over the case in view of the sensitivities involved.

India-Qatar relationship:

- Qatar is home to about 7 lakh Indian nationals, making up the largest expatriate community in Qatar.

- Purnendu Tiwari, who was managing director of the company, received the Pravasi Bharatiya Samman in 2019 for his services in furthering the bilateral relationship between India and Qatar.

- The verdict is the first major crisis to hit the India-Qatar relationship, which has generally remained steady so far.

- Indian Prime Minister Narendra Modi visited Doha in 2016, followed by his meeting with the Emir of Qatar on the sidelines of the UN General Assembly in New York in 2019.

- External Affairs Minister also visited Qatar in February 2022.

Bilateral relations:

- Qatar is the largest supplier of LNG to India, which accounts for over 48% of India’s global LNG imports. India also imports ethylene, propylene, ammonia, urea, and polyethylene from Qatar.

FinMin notifies rules for appointment of president, members in GSTAT

(GS Paper 3, Economy)

Why in news?

- Recently, the Finance Ministry has notified the rules for the appointment of the president and members of GST appellate tribunals.

Details:

- The GST council, chaired by the Union Finance Minister and comprising state counterparts, in its 52nd meeting decided that the maximum age limit for the president and members of the GST Appellate Tribunal (GSTAT) would be 70 years and 67 years, respectively.

- Goods and Services Tax Appellate Tribunal (Appointment and Conditions of Service of President and Members) Rules, 2023, defines the rule for appointment and removal of the president and members of the appellate tribunals, their salary, allowances, pension, provident fund, gratuity and leave.

- In September, the finance ministry had notified 31 benches of GSTAT, which will be set up in 28 states and 8 Union Territories.

Benches of GSTAT:

- Gujarat and UTs; Dadra and Nagar Haveli and Daman and Diu will have two benches of the GSTAT; Goa and Maharashtra together will have three benches.

- Karnataka and Rajasthan will have two benches each, while Uttar Pradesh will have three benches.

- West Bengal, Sikkim, Andaman and Nicobar Islands, Tamil Nadu and Puducherry will together have two GSTAT benches each, while Kerala and Lakshadweep will have one bench.

- The seven northeastern states; Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland and Tripura will have one bench each.

- All other states will have one bench of the GSTAT.

Way Forward:

- Setting up state-level benches of GSTAT would help businesses by way of faster dispute resolution.

- Currently, taxpayers aggrieved with the ruling of tax authorities are required to move to the respective High Courts.

- The resolution process takes longer time as High Courts are already burdened with a backlog of cases and do not have a specialised bench to deal with GST cases.

SC allows surrogacy, strikes down rule banning use of donor gametes

(GS Paper 2, Health)

Why in news?

- The Supreme Court has protected the right of parenthood of a woman, suffering from a rare medical condition, by staying the operation of a law which threatened to wreck her hopes to become a mother through surrogacy.

Details:

- The woman has the Mayer Rokitansky Kuster Hauser syndrome.

- Medical board records showed she has “absent ovaries and absent uterus, hence she cannot produce her own eggs/oocytes”. The couple had begun the process of gestational surrogacy on December 7, 2022.

Petition Amendment in March 2023:

- The petition was filed in the Supreme Court challenging the amendment as a violation of a woman’s right to parenthood.

- Gametes are reproductive cells. In animals, the male gametes are sperms and the female gamete is the ovum or egg cells.

- On March 14, 2023, the Ministry of Health and Family Welfare published General Statutory Rules (GSR) 179 (E) which stated,

- a couple undergoing surrogacy must have both gametes from the intending couple and donor gametes are not allowed

- single women (widow/divorcee) undergoing surrogacy must use self-eggs and donor sperms to avail surrogacy procedure.

- Section 2(h) of the Assisted Reproductive Technology Regulation Act, 2021 defines "gamete donor" as a person who provides sperm or oocyte with the objective of enabling an infertile couple or woman to have a child.

Gestational surrogacy:

- The plea claimed the said GSR has the effect of frustrating the provisions of the Surrogacy (Regulations) Act, 2021 which is a welfare legislation giving right of parenthood to infertile couples.

- It contradicted Sections 2(r) and 4 of the Surrogacy Act, 2021, which recognised the situation when a medical condition would require a couple to opt for gestational surrogacy in order to become parents.

- Rule 14(a) of the Surrogacy Rules which listed the medical or congenital conditions owing to which a woman could choose to become a mother through gestational surrogacy.

- They included “having no uterus or missing uterus or abnormal uterus (like hypoplastic uterus or intrauterine adhesions or thin endometrium or small unicornuate uterus, T-shaped uterus) or if the uterus is surgically removed due to any medical condition such as gynaecological cancer.

SC judgement:

- In the case before SC, the woman had begun the surrogacy process months before the amendment, which cannot be implemented retrospectively.

- In an 11-page order, the SC court agreed that the law permitting gestational surrogacy was “woman-centric”. The decision to have a surrogate child was entirely based on the woman’s inability to become a mother owing to her medical or congenital condition.

- Such a condition included the “absence of a uterus or repeatedly failed pregnancies, multiple pregnancies or an illness which makes it impossible for her to carry a pregnancy to term or would make the pregnancy life-threatening”.

- The amendment cannot contradict Rule 14(a) which specifically recognises the absence of a uterus or any allied condition as a medical indication necessitating gestational surrogacy.

- Addressing the government’s contention that the surrogate child should be “genetically related” to the couple, the court said the child would be related to the husband.

- The expression ‘genetically’ related to the intending couple has to be read as being related to the husband when Rule 14(a) applies, the court said.